There may be hope in sight for traders reeling from the recent market swoons and it comes from an unlikely source - Russia.

An adage among the soccer faithful has it that the summer lull in markets kicks off early whenever the World Cup takes place. A look at historical volatility data suggests they may -- just -- have a point.

As humanity’s most popular sport, the quadrennial World Cup is one of the biggest events in the global calendar -- an occasion that in theory is global enough to compete for the attention of traders, with muted price swings the result.

“There’s nothing like a World Cup to keep people completely distracted,” said Greg Saichin, a bond investor at Allianz Global Investors in London. “Hopefully volatility will come down and we’ll be able to clip the coupon for five weeks.”

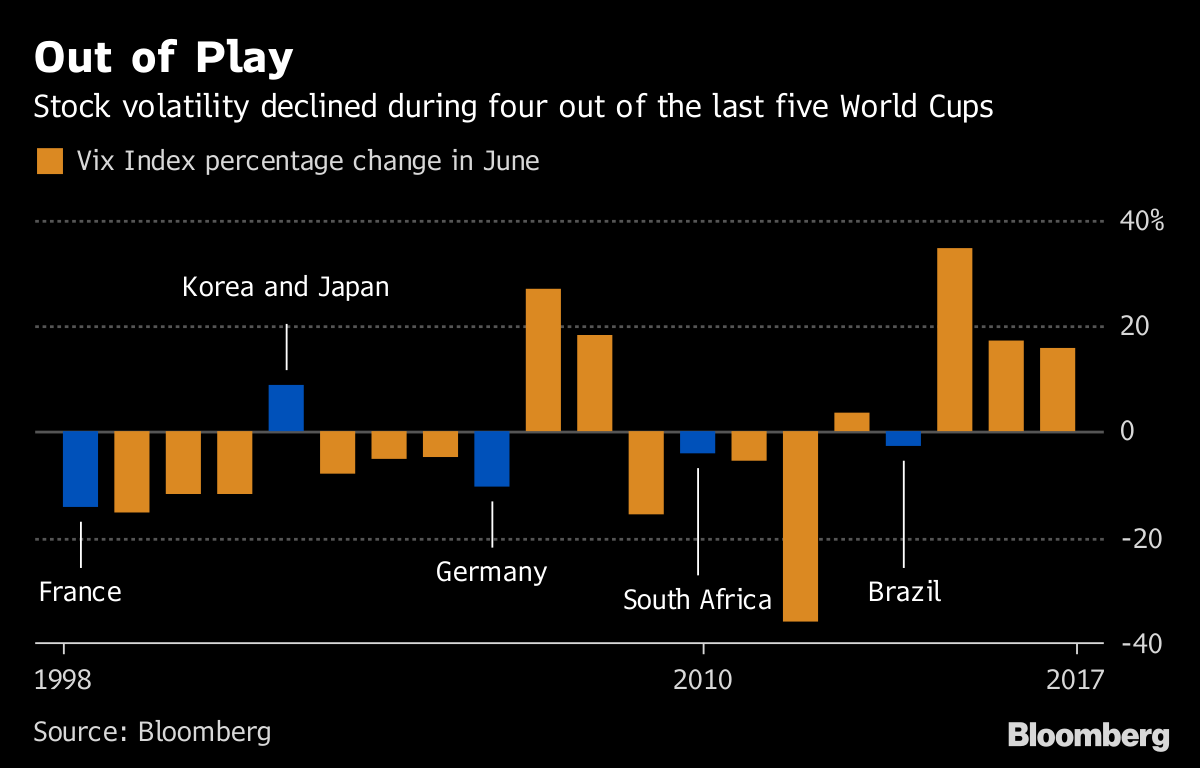

Out of PlayStock volatility declined during four out of the last five World Cups

Source: Bloomberg

.chart-js { display: none; }

Indeed, in four out of the last five World Cups, market volatility did show declines in June, according to a Bloomberg analysis. The drops were bigger when the tournament was held in Europe, when matches were more likely to take place in busier trading hours, and volatility rose in 2002, when the competition took place in Asia.

This year’s event will take place in Russia from June 15 until July 15 and will include teams from 32 countries.

The volatility declines are slight, suggesting investors might not be able to lavish the championship with their full attention. Party poopers will tell you that trading volumes don’t show similar falls, failing to back up the hoped-for trend.

Still, the good news is that most of the participating squads hail from Europe and emerging markets, suggesting traders from sources of the recent market gyrations may be distracted.

The bad news is that the U.S., China and North Korea aren’t taking part.

LISTEN TO ARTICLE 1:41 Share Share on Facebook Post to Twitter Send as an Email Print

No comments:

Post a Comment