The S&P 500 (SNPINDEX: ^GSPC ) has soared in the past four years, leading many to fear that the index is long overdue for a major correction. In times of trouble, value investors often look to stocks that trade at low valuations compared with their peers to provide a margin of safety from a potential downturn.

Yet judging stocks on a single valuation metric can lead to misleading conclusions that can prove costly. Today, let's take a look at some of the least expensive stocks in the S&P on a price-to-book value basis, with an eye toward understanding why book value might not be the best way to judge whether these stocks are truly cheap.

The cheapest stocks in the S&P

On a book-value basis, financial stocks have had low book values for a long time. Genworth Financial (NYSE: GNW ) trades at just one-third of book value, while plenty of other insurance companies and banks offer price-to-book ratios of between 0.5 and 0.75. Yet during the financial crisis, investors learned just how inaccurate book values were. Massive writedowns of toxic assets proved necessary to reflect the actual value of those assets, and as a result, price-to-book ratios temporarily soared even as stock prices plunged.

Hot Financial Companies To Own For 2014: Guthrie Gts Ltd (G33.SI)

Guthrie GTS Limited, an investment holding company, engages in property, engineering, and leisure businesses in Singapore, Indonesia, and internationally. The company operates through three segments: Property, Engineering, and Leisure. The Property segment engages in the investment, development, and management of retail, commercial, and residential properties; and project management, as well as retail planning, consultancy, marketing, leasing, and mall management. The Engineering segment is involved in undertaking engineering contracts, and trading related products; and the provision of professional services to the transport, telecommunications, air-conditioning, electrical, and fire protection, as well as building and facility management sectors. The Leisure segment invests in, and operates hotels and a golf resort, which comprise the Mercure Vientiane hotel in Laos, the Pullman Jakarta Indonesia hotel in Jakarta, the Novotel Bali Benoa hotel in Bali, and the Indah Puri G olf Resort in Batam. It also offers warehousing facilities; and marketing services to golf clubs and hotels. The company was formerly known as Mulpha (Singapore) Ltd. and changed its name to Guthrie GTS Limited in 1988. Guthrie GTS Limited was founded in 1821 and is headquartered in Singapore.

Hot Financial Companies To Own For 2014: American Select Portfolio Inc.(SLA)

American Select Portfolio Inc. is a close ended fixed income mutual fund launched and managed by FAF Advisors, Inc. It is co-managed by Nuveen Fund Advisors, Inc. and Nuveen Asset Management, LLC. The fund invests in the fixed income markets of the United States. It primarily invests in mortgage-related assets that directly or indirectly represent a participation in or are secured by and payable from mortgage loans. The fund has an overall credit quality of BBB. It benchmarks the performance of its portfolio against the Lehman Brothers Mutual Fund Government/Mortgage Index. The fund will not invest in inverse floaters, principal-only securities, interest-only securities, inverse interest-only securities, Z-bonds. American Select Portfolio Inc. was formed on September 21, 1993 and is domiciled in the United States.

Top Clean Energy Companies To Invest In Right Now: The Wharf (4)

The Wharf (Holdings) Limited is an investment holding company. It has four segments: property investment, which includes property leasing and hotel operations, and its properties portfolio consists of retail, office, service apartments and hotels, and is primarily located in Hong Kong and Mainland China; property development, which involves activities relating to the acquisition, development, design, construction, sale and marketing of its trading properties primarily in Hong Kong and Mainland China; logistics, which includes the container terminal operations undertaken by Modern Terminals Limited (Modern Terminals), Hong Kong Air Cargo Terminals Limited and other public transport operations, and communications, media and entertainment (CME), which comprises pay television, Internet and multimedia and other businesses operated by its non-wholly-owned subsidiary, i-CABLE Communications Limited and also includes the telecommunication businesses operated by Wharf T&T Limited.Hot Financial Companies To Own For 2014: ARMOUR Residential REIT Inc (ARR)

ARMOUR Residential REIT, Inc.( ARMOUR), incorporated on February 5, 2008, is an externally-managed Maryland corporation managed by ARMOUR Residential REIT, Inc. The Company invests primarily in hybrid adjustable rate, adjustable rate and fixed rate residential mortgage backed securities (RMBS). These securities are issued or guaranteed by a United States Government-sponsored entity (GSE), such as the Federal National Mortgage Association (Fannie Mae) or the Federal Home Loan Mortgage Corporation (Freddie Mac), or are guaranteed by the Government National Mortgage Administration (Ginnie Mae) collectively, Agency Securities. From time to time, a portion of its portfolio may be invested in unsecured notes and bonds issued by United States Government-chartered entities, collectively, Agency Debt. As of December 31, 2012, Agency Securities account for 100% of its portfolio.

The Company seeks long-term investment returns by investing its equity capital and borrowed funds in its targeted asset class of Agency Securities. The Company�� assets have been invested in Agency Securities or money market instruments, primarily deposits at federally chartered banks. The Company borrows against its Agency Securities using repurchase agreements. Its borrowings generally have maturities that may range from one month or less, up to one year, although occasionally it may enter into longer dated borrowing agreements to more closely match the rate adjustment period of its Agency Securities.

Advisors' Opinion:- [By Amanda Alix]

All mREITs are taking it on the chin

The agency crew, led by heavy hitters Annaly Capital (NYSE: NLY ) , American Capital Agency (NASDAQ: AGNC ) , and Armour Residential (NYSE: ARR ) , have all been close to hitting 52-week lows, but the blood-letting hasn't stopped there. Even hybrid mortgage REITs, which also buy some non-agency paper, have plunged, as well. Two Harbors (NYSE: TWO ) , which enjoyed such a nice lift post-earnings about a month ago, recently sunk to new lows, and Invesco Mortgage Capital (NYSE: IVR ) has also slipped, even after its CIO's recent show of faith, making a sizable insider purchase�of stock less than two weeks ago. - [By Zain Zafar]

In terms of book value loss, Hatteras' performance can be compared to that of ARMOUR Residential (NYSE: ARR ) , whose book value per share declined by 19% from the previous quarter. However, ARMOUR Residential follows a strategy of investing primarily in long-duration fixed-rate MBSes, which can carry much larger interest rate risk.

- [By Amanda Alix]

Mortgage REITs begin their plunge

It didn't take long for investors to show their concern, and by mid-afternoon yesterday, Annaly Capital (NYSE: NLY ) and fellow agency players American Capital Agency (NASDAQ: AGNC ) and Armour Residential (NYSE: ARR ) had dropped sharply after the opening bell. By the market's close, each fell by 0.69%, 0.87%, and 1.23%, sequentially. - [By Thomas Bradshaw]

Armour Residential REIT (ARR) is an interesting REIT that was set up to invest in Agency residential mortgage backed securities. It seems like quite a simple model: buy mortgages that are primarily guaranteed by Fannie Mae (even throw in some Freddie Mac and Ginnie Mae) and hold those to maturity, collecting coupons on the way. Since the assets would be held to maturity, no need to worry about the market value of the securities because we know what the fixed income stream will be and the face value of the securities won't change over time.

Hot Financial Companies To Own For 2014: Susquehanna Bancshares Inc.(SUSQ)

Susquehanna Bancshares, Inc., through its subsidiaries, provides retail and commercial banking, and financial services in the mid-Atlantic region. Its retail banking services include checking, savings, and club accounts, as well as check cards, debit cards, money market accounts, certificates of deposit, individual retirement accounts, home equity lines of credit, residential mortgage loans, home improvement loans, automobile loans, personal loans, and Internet banking services. The company?s commercial banking services comprise business checking accounts, cash management services, money market accounts, land acquisition and development loans, commercial loans, floor plan, equipment and working capital lines of credit, small business loans, and Internet banking services. It also offers commercial, property, and casualty insurance; and risk management programs for medium and large sized companies. In addition, it provides traditional trust and custodial services, as well a s acts as an administrator, executor, guardian, and managing agent for individuals, businesses, and non-profit entities. Further, the company offers investment advisory, asset management, and brokerage services for institutional and high net worth individual clients; and provides retirement planning services. Additionally, it engages in the equity management of assets for institutions, pensions, endowments, and high net worth individuals; and provides consumer vehicle financing services. The company operates 221 branches and 26 free-standing automated teller machines. Susquehanna Bancshares, Inc. was founded in 1982 and is based in Lititz, Pennsylvania.

Advisors' Opinion:- [By Rich Duprey]

Financial services holding company�Susquehanna Bancshares (NASDAQ: SUSQ ) announced yesterday its third-quarter dividend of $0.08 per share, the same rate it paid last quarter after raising the payout 14%, from $0.07 per share.

Why there isn't a bond bubble

Why there isn't a bond bubble

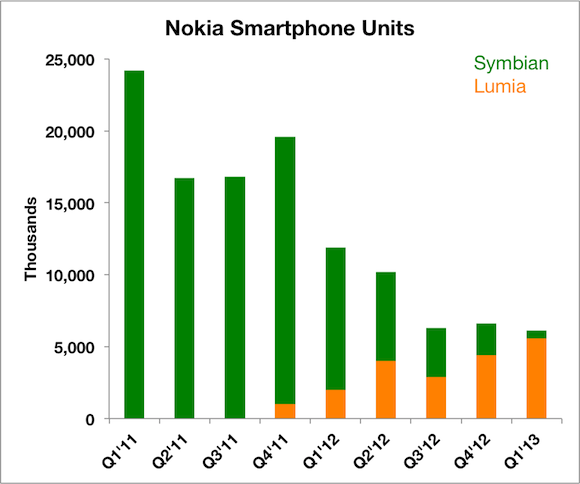

[ Enlarge Image ]

[ Enlarge Image ] [ Enlarge Image ]

[ Enlarge Image ] [ Enlarge Image ]

[ Enlarge Image ]

) announced third quarter revenues that fell 14% to $5.89 billion from $6.8 billion in 2012′s Q3. The company attributed the loss to the weak yen/USD exchange rate. Net earnings for the company came in at $702 million, or $1.50 per share, which was down from $1 billion, or $2.16 per share, a year ago. Not including one-time items, AFL’s EPS came in at $1.47, which missed analysts’ estimates of $1.48. Revenues barely missed analyst views of $5.9 billion. The company announced its 2014 share buyback program being in the range of $800 million to $1 billion.

) announced third quarter revenues that fell 14% to $5.89 billion from $6.8 billion in 2012′s Q3. The company attributed the loss to the weak yen/USD exchange rate. Net earnings for the company came in at $702 million, or $1.50 per share, which was down from $1 billion, or $2.16 per share, a year ago. Not including one-time items, AFL’s EPS came in at $1.47, which missed analysts’ estimates of $1.48. Revenues barely missed analyst views of $5.9 billion. The company announced its 2014 share buyback program being in the range of $800 million to $1 billion.