Hedge funds overall have been lackluster performers in this bull market. In 2014, for example, they’re up just 1% so far compared with 7.5% for the Standard & Poor’s 500, according to Goldman Sachs. Goldman analyzed performance from 775 hedge funds with $1.9 trillion under management.

The reality is that the S&P 500 has been one of the world’s best-performing categories over the last five-plus years. Yet hedge funds often employ sophisticated, complex strategies in an effort to deliver outsized performance. This also may be an attempt to justify their ridiculous fees, such as the infamous “2 and 20″–2% annual management charge plus 20% of the profits.

Stick to stock picking? How boring! But hedge funds’ performance would actually improve significantly if they did just that.

Goldman Sachs periodically compiles a list of 50 stocks that "matter most" to hedge funds. These are the stocks that are most frequently among the top-10 holdings of hedge-fund portfolios. Since 2001, the lists of these 50 stocks have outperformed the S&P 500 on a quarterly basis 66% of the time, according to Goldman.

Here are the top 50 stocks in hedge funds as of the end of the second quarter:

Company | Ticker | Subsector | Market Value ($billions) | Funds Top 10 | Return %YTD |

Actavis Plc | ACT | Pharmaceuticals | 57 | 67 | 28 |

Apple Inc. | AAPL | Technology Hardware | 591 | 57 | 24 |

Facebook Inc. | FB | Internet Software &am! p; Services | 189 | 43 | 35 |

Allergan Inc. | AGN | Pharmaceuticals | 47 | 41 | 43 |

American Airlines Group | AAL | Airlines | 28 | 41 | 56 |

General Motors | GM | Automobile Manufacturers | 54 | 41 | -16 |

Time Warner Cable | TWC | Cable & Satellite | 41 | 41 | 11 |

American Intl Group | AIG | Multi-line Insurance | 78 | 40 | 6 |

Microsoft Corp. | MSFT | Systems Software | 370 | 38 | 21 |

Hertz Global Holdings | HTZ | Trucking | 13 | 33 | 5 |

Charter Communications | CHTR | Cable & Satellite | 17 | 32 | 14 |

Micron Technology | MU | Semiconductors | 34 | 32 | 45 |

Williams Companies | WMB | Oil & Gas Storage & Transportation | 43 | 29 | 53 |

Cheniere Energy | LNG | Oil & Gas Storage & Transportation | 17 | 28 | 70 |

Citigroup Inc. | C | Diversified Banks | 148 | 28 | -6 |

Delta Air Lines | DAL | Airlines | 33 | 27 | 41 |

HCA | Health Care Facilities | 30 | 26 | 42 | |

Anadarko Petroleum | APC | Oil & Gas Exploration & Production | 55 | 25 | 37 |

CBS Corp. | CBS | Broadcasting | 31 | 25 | -6 |

Ally Financial Inc. | ALLY | Consumer Finance | 12 | 24 | -0.3 |

Google Inc. | GOOGL | Internet Software & Services | 394 | 23 | 4 |

Air Products and Chemicals | APD | Industrial Gases | 28 | 22 | 20 |

NorthStar Realty Finance | NRF | Mortgage REITs | 3 | 22 | 45 |

Bank of America | BAC | Diversified Banks | 160 | 21 | -2 |

eBay Inc. | EBAY | Internet Software & Services | 67 | 21 | -4 |

Liberty Global | LBTYK | Cable & Satellite | 33 | 21 | 0 |

Priceline Group | PCLN | Internet Retail | 67 | 21 | 9 |

Valeant Pharma. International | VRX | Pharmaceuticals | 37 | 21 | -4 |

Baidu Inc. | BIDU | Internet Software & Services | 77 | 20 | 23 |

DIRECTV | DTV | ! Cable &am! p; Satellite | 42 | 20 | 22 |

DISH Network Corp. | DISH | Cable & Satellite | 30 | 20 | 12 |

Dollar General | DG | General Merchandise Stores | 17 | 20 | -5 |

Equinix Inc. | EQIX | Internet Software & Services | 11 | 19 | 22 |

MasterCard Inc. | MA | Data Processing & Outsourced Services | 88 | 19 | -10 |

Walgreen Co. | WAG | Drug Retail | 59 | 19 | 9 |

American Realty Capital Properties | ARCP | Diversified REITs | 12 | 18 | 7 |

Gilead Sciences | GILD | Biotechnology | 153 | 18 | 32 |

Liberty Interactive | LINTA | Catalog Retail | 14 | 18 | -3 |

Monsanto Co. | MON | Fertilizers & Agricultural Chemicals | 62 | 18 | 3 |

Twenty-First Century Fox | FOXA | Movies & Entertainment | 80 | 18 | 2 |

Visteon Corp. | VC | Auto Parts & Equipment | 4 | 18 | 20 |

Amazon.com Inc. | AMZN | Internet Retail | 154 | 17 | -16 |

Berkshire Hathaway | BRK. | Multi-Sector Holdings | 17 13 | ||

SunEdison Inc. | SUNE | Semiconductor Equipment | 6 | 17 | 64 |

Comcast Corp. | CMCSA | Cable & Satellite | 142 | 16 | 6 |

JPMorgan Chase | JPM | Diversified Banks | 215 | 16 | -1 |

Macquarie Infrastructure LLC | MIC | Airport Services | 4 | 16 | 38 |

Crown Castle Intl | CCI | Specialized REITs | 26 | 15 | 8 |

Hess Corp. | HES | Integrated Oil & Gas | 31 | 15 | 20 |

Lamar Advertising | LAMR | Advertising | 5 | 15 | -1 |

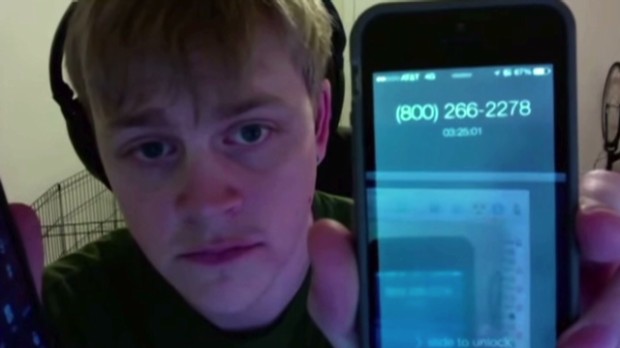

Comcast customer's frustration goes viral NEW YORK (CNNMoney) Viral recordings of Comcast customer service snafus are becoming a highly watched mini-series.

Comcast customer's frustration goes viral NEW YORK (CNNMoney) Viral recordings of Comcast customer service snafus are becoming a highly watched mini-series.  Comcast: Poor service, good stock

Comcast: Poor service, good stock

Popular Posts: 5 High-Dividend Stocks Yielding 5%-PlusWhat If the Alibaba IPO Is a Flop?11 Best Cheap Stocks Under $10 to Buy Now Recent Posts: Where’s the Market Headed From Here? GOOG and BKS – Can Google Deal Keep Barnes & Noble Alive? PCLN and CTRP – How Priceline Will Take Over China View All Posts PCLN and CTRP – How Priceline Will Take Over China

Popular Posts: 5 High-Dividend Stocks Yielding 5%-PlusWhat If the Alibaba IPO Is a Flop?11 Best Cheap Stocks Under $10 to Buy Now Recent Posts: Where’s the Market Headed From Here? GOOG and BKS – Can Google Deal Keep Barnes & Noble Alive? PCLN and CTRP – How Priceline Will Take Over China View All Posts PCLN and CTRP – How Priceline Will Take Over China  In the past five years, PCLN stock is up an amazing 880%, and that outperformance has slowed only slightly as Priceline stock has put up 39% returns in the past 12 months vs. a gain of just 13% for the S&P 500 in the same period.

In the past five years, PCLN stock is up an amazing 880%, and that outperformance has slowed only slightly as Priceline stock has put up 39% returns in the past 12 months vs. a gain of just 13% for the S&P 500 in the same period.

Agence France-Presse/Getty Images

Agence France-Presse/Getty Images