AAA estimates that during this Christmas and New Year's season, nearly 95 million Americans will hit the road, traveling long distances to visit friends and family. Unfortunately, during the end-of-year holiday travel period, nearly 27,900 Americans will be seriously injured in auto accidents, and more than 250 will die.

The National Safety Council (NSC) has released reports estimating the number of traffic accidents and fatalities that occur on major holidays, including Christmas, New Year's, Thanksgiving, Memorial Day, Labor Day, and Independence Day. According to the NSC, the deadliest holiday this year will likely be the Fourth of July, which saw an estimated 540 motorists die during the travel period, which spans roughly four days. 24/7 Wall St. reviewed the NSC's most recent estimates of motor vehicle accidents and casualties for the six big holidays.

Ken Kolosh, manager of statistics at the NSC, explained that while travel during all these major holidays increases, the number of fatalities doesn't always jump significantly. "The New Year's holiday generally results in a significant increase in the number of fatalities when looking at a comparable period in same month," Kolosh noted. On the other hand, he added that in the case of Christmas, there isn't a significant increase.

One major reason for the difference may be alcohol consumption. A separate report released by the Council this month shows that holidays like New Year's Day and Independence Day are more likely to see people drink and drive. During the New Year's period, between 2007 and 2011, an estimated 42% of traffic fatalities were the result of drinking and driving. On Christmas, just 35% of accidents were the result of drinking and driving, less than any of the major six holidays.

As might be expected, poor weather is regularly a factor in the accidents and deaths on the road. However, according to Kolosh, the actual effects of a severe blizzard on a major holiday are not what you might expect. "It's a little bi! t counterintuitive, but good weather in winter months actually results in more fatalities," he said. The reason for this, he explained, is people are less likely to travel more than absolutely necessary in bad weather.

For each holiday, the number of accidents fluctuates each year. In 2012, there were more than 350 fatalities during the Christmas travel period. This year, the National Safety Council estimates there will be just 105. The figure is lower largely because Christmas falls in the middle of the week and the travel period isn't spread out over a weekend.

Traffic accidents and deaths during a holiday are also influenced by how many people actually travel that year. According to Kolosh, the strength of the economy influences the amount of driving Americans do. "Macroeconomic issues such as recessions greatly impact fatalities on the road," he said. "Recessions actually tend to save lives on the road. We've reached some really historic lows during the last recession."

Between 2003 and 2008, years when U.S. unemployment was relatively low, there were at least 370 traffic fatalities during the Christmas season. Between 2009 and 2011, when U.S. unemployment was at its worst, fatalities averaged around 250 per Christmas travel period.

To identify the most dangerous holidays, 24/7 Wall St. reviewed the National Safety Council's estimates for the six holidays it measures of traffic accidents and fatalities occurring during that holiday travel period. All figures for 2013 and 2014 are estimates from the NSF. Travel periods change year-to-year, depending on which day of the week the holiday occurs. The NSC also estimated the proportion of traffic fatalities caused by alcohol consumption. Those figures are based 2007-2011 averages.

These are the most dangerous holidays

6. Christmas Day

> Estimated fatalities: 105

> Deaths prevented by seatbelts: 38

According to AAA estimates, holiday travel at Christmas will increase this holiday season for the fifth! year in ! a row. About 30% of Americans are expected to travel during this time. From the afternoon of Christmas Eve through Christmas Day, the NSC estimates there will be 105 deaths and an additional 11,200 severe injuries in traffic accidents. This is significantly lower than in previous years. Last year, there were 351 fatalities. This decline is largely because Christmas falls in the middle of the week and the traveling period is significantly shorter than usual. The worst Christmas in recent history was in 2001, when 575 people were killed.

5. New Year's Day

> Estimated fatalities: 156

> Deaths prevented by seatbelts: 57

People are much more likely to drink and drive around January 1 than during any other major holiday. Nearly half of all 286 traffic fatalities during the New Year's travel period in 2010 were alcohol related. Between 2007 and 2011, alcohol accounted for 42% of all traffic deaths during the holiday. By comparison, during Christmas, alcohol was a factor in just 35% of fatalities. The 2010 New Year's period represented a low point for fatalities, at just 286. Traffic deaths ticked up to 348 by 2012. However, since the upcoming New Year's day — like Christmas — falls in the middle of the week, the total travel period for the holiday is shorter, the estimated 156 fatalities would be the lowest in some time. Safety is another reason the number of fatalities is projected to be so low, as the NSC estimates that 57 lives will saved by seat belts during the holiday.

MORE: Top 10 cars with the best resale value

4. Labor Day

> Estimated fatalities: 394

> Deaths prevented by seatbelts: 143

According to a AAA estimate, roughly 34.1 million Americans traveled at least 50 miles over the long Labor Day weekend this year. During the holiday period, which ran from Friday evening through midnight Monday, there were nearly 400 traffic-related deaths and more than 42,000 serious injuries, according to the NSC. If this year's estimate is accurate, th! ere will ! not have been more than 400 driving fatalities during Labor Day for five straight years. Between 1995 and 2008, there were at least 450 deaths every year.

3. Thanksgiving Day

> Estimated fatalities: 436

> Deaths prevented by seatbelts: 158

Over the six-year period between 2006 and 2011, traffic deaths around Thanksgiving accounted for nearly 15% of all vehicle-related fatalities in November. Between 2001 and 2007, driving fatalities during the holiday were in excess of 500 each year, peaking at 623 in 2006. Over the last five years, however, deaths have not exceeded 500. In 2011, just 375 people died on the road over the holiday, the fewest deaths since at least 1995. This year, the NSC estimates deaths rose to 436, with an additional 46,600 nonfatal injuries, which include all unintentional injuries that require medical consultation, over the travel period running from Wednesday evening through Sunday.

MORE: Eight states with the highest minimum wages

2. Memorial Day

> Estimated fatalities: 407

> Deaths prevented by seatbelts: n/a

Fireworks over the U.S. Capitol and Washington Monument on July 4, 2013.(Photo: Paul J. Richards, AFP/Getty Images)

Memorial Day weekend — the first major holiday weekend of the year and widely considered the start of summer — has 13.1% more traffic deaths, on average, than a typical non-holiday weekend. The Monday of the four-day weekend, Memorial Day itself, has 32% more fatalities than the preceding three days, according to a study on holiday fatalities by Arnold and Cerrelli. The reason is likely the increased travel during the last long weekend day. The NSC estimate of 407 traffic deaths during the 2013 Memorial Day weekend is slightly higher than the 367 deaths du! ring the ! 2012 holiday weekend. Since 2010, driving deaths during the holiday have remained below 400. Before 2010, the last time there were less than 400 deaths was 1998.

1. Independence Day

> Estimated fatalities: 540

> Deaths prevented by seatbelts: 196

The NSC estimates that the Fourth of July will go down as the most dangerous holiday for travelers in 2013 with 540 deaths and nearly 58,000 serious injuries. Drinking and driving played a major role in this. According to data from the National Highway Traffic Safety Administration, between 2007 and 2011, alcohol accounted for 61 traffic fatalities per day over the Independence Day travel period, more than any other major holiday. Between 2007 and 2008, motor vehicle deaths around Independence Day more than doubled from 184 to 472. However, even the fatality rate that year did not approach the levels of the early 2000's, when deaths exceeded 500 nearly every year. In 2006, there were 629 automobile-related deaths. In 2002, there were 662.

24/7 Wall St. is a USA TODAY content partner offering financial news and commentary. Its content is produced independently of USA TODAY.

Getty Images From birth, we're raised thinking mommy and daddy know best. They have our best interests in mind when they scare away tattooed teenage boys, keep the liquor under lock and key, and set our curfews earlier than those of all our other friends. Unfortunately, when it comes to money, mommy and daddy might be leading you astray. Financial literacy rates in the Millennial generation are abysmal. This year the Treasury Department and Department of Education tested the financial literacy of 84,000 high schoolers, who scored an average of 69 percent. With little to no financial literacy taught in our education system, children have no choice but to learn from dear old Mom and Dad. But if Mom and Dad were never taught -- or never bothered to learn -- how to appropriately handle money, they sure aren't the ones who should be giving financial advice. If you've ever heard your parents say, "Don't get a credit card," they were wrong. Credit cards are one of the easiest ways to build your credit score. Granted, establishing new credit only makes up 10 percent of your score, but if you aren't paying off loans yet, it might be the only way for you to establish a line of credit. Length of credit history makes up 15 percent of your score, so the longer you've had a "healthy" history, the higher your score will typically be. Parents are often reluctant to give their college-age children access to plastic, but if you know how to treat your card right, it'll pay off. When you graduate and start looking for an apartment, a respectable credit score is important to your landlord, while a lack of one can prevent you from signing a lease. If you've ever heard your parents say, "Keep a monthly balance on your credit card," they were wrong. Somehow, parents heard a rumor that keeping a monthly balance on your credit card will help your credit score. They spout some nonsense about how paying the minimum shows responsibility and increases your score. False. Carrying a balance does nothing to improve your score and instead costs you more money because you're accumulating interest on the balance. Instead, pay off your credit card in full each month (which means not charging more to the card than you know you can afford). If you've ever heard your parents say, "X,Y or Z college is worth the student loan debt," they were wrong. Millennials are drowning in student loan debt. As a generation, our debt is so horrific it's predicted to delay our retirement age until 73. For many millennials, it's too late to turn back now; the debt has already been accumulated. The only hope is to diligently, or quickly, pay down debt, and simultaneously start figuring out how to save for retirement from the moment you get your first paycheck. The other option is to start a side hustle and increase your influx of cash. For the younger millennials and Generation Z, there's still hope. When considering college, apply to every scholarship you qualify for. Sometimes your GPA doesn't matter as much as your height or your ability to call ducks. It's a good idea to set your pride aside during your college-decision-making process and really evaluate whether the ROI of your major at X, Y or Z school is worth tens of thousands of dollars in debt. If not, consider state schools, smaller liberal-arts colleges, or simply choosing the college that offered you the best financial package. If you've ever heard your parents say, "Don't invest in the stock market; it's just gambling," they were wrong. Yes, 2008 was a tough year, and the market took a tumble. Boomers lost money and some saw their retirement accounts take a hit. Unfortunately, this led to the millennial generation developing a great mistrust of the stock market. While we might be reluctant to get in bed with the stock market, it's certainly still willing to love us. The greatest advantage for an investor is time, and time is exactly what 20- to 30-year-olds possess. If you're not quite ready for index funds, mutual funds or buying individual stocks, you should at least contribute to your company-matched 401(k)s or open a Roth or Traditional IRA. If you've ever heard your parents say, "Have babies," they were wrong. Starting a family is certainly a personal choice, but not one you should be making based on parental pressure. Raising a child is a tremendous financial commitment. In 2012, it cost middle-income parents $286,860 to raise a child from birth to age 17. If you're willing to pay for college in full, then you can tack on an extra $100,000 or more. For many millennials stuck in the red, starting a family could complicate an already stressful financial situation. Parents mean well, but sometimes their advice comes from a negative personal experience or a lack of knowledge. Instead of always trusting their financial advice, be sure to educate yourself and check against credible sources.

Getty Images From birth, we're raised thinking mommy and daddy know best. They have our best interests in mind when they scare away tattooed teenage boys, keep the liquor under lock and key, and set our curfews earlier than those of all our other friends. Unfortunately, when it comes to money, mommy and daddy might be leading you astray. Financial literacy rates in the Millennial generation are abysmal. This year the Treasury Department and Department of Education tested the financial literacy of 84,000 high schoolers, who scored an average of 69 percent. With little to no financial literacy taught in our education system, children have no choice but to learn from dear old Mom and Dad. But if Mom and Dad were never taught -- or never bothered to learn -- how to appropriately handle money, they sure aren't the ones who should be giving financial advice. If you've ever heard your parents say, "Don't get a credit card," they were wrong. Credit cards are one of the easiest ways to build your credit score. Granted, establishing new credit only makes up 10 percent of your score, but if you aren't paying off loans yet, it might be the only way for you to establish a line of credit. Length of credit history makes up 15 percent of your score, so the longer you've had a "healthy" history, the higher your score will typically be. Parents are often reluctant to give their college-age children access to plastic, but if you know how to treat your card right, it'll pay off. When you graduate and start looking for an apartment, a respectable credit score is important to your landlord, while a lack of one can prevent you from signing a lease. If you've ever heard your parents say, "Keep a monthly balance on your credit card," they were wrong. Somehow, parents heard a rumor that keeping a monthly balance on your credit card will help your credit score. They spout some nonsense about how paying the minimum shows responsibility and increases your score. False. Carrying a balance does nothing to improve your score and instead costs you more money because you're accumulating interest on the balance. Instead, pay off your credit card in full each month (which means not charging more to the card than you know you can afford). If you've ever heard your parents say, "X,Y or Z college is worth the student loan debt," they were wrong. Millennials are drowning in student loan debt. As a generation, our debt is so horrific it's predicted to delay our retirement age until 73. For many millennials, it's too late to turn back now; the debt has already been accumulated. The only hope is to diligently, or quickly, pay down debt, and simultaneously start figuring out how to save for retirement from the moment you get your first paycheck. The other option is to start a side hustle and increase your influx of cash. For the younger millennials and Generation Z, there's still hope. When considering college, apply to every scholarship you qualify for. Sometimes your GPA doesn't matter as much as your height or your ability to call ducks. It's a good idea to set your pride aside during your college-decision-making process and really evaluate whether the ROI of your major at X, Y or Z school is worth tens of thousands of dollars in debt. If not, consider state schools, smaller liberal-arts colleges, or simply choosing the college that offered you the best financial package. If you've ever heard your parents say, "Don't invest in the stock market; it's just gambling," they were wrong. Yes, 2008 was a tough year, and the market took a tumble. Boomers lost money and some saw their retirement accounts take a hit. Unfortunately, this led to the millennial generation developing a great mistrust of the stock market. While we might be reluctant to get in bed with the stock market, it's certainly still willing to love us. The greatest advantage for an investor is time, and time is exactly what 20- to 30-year-olds possess. If you're not quite ready for index funds, mutual funds or buying individual stocks, you should at least contribute to your company-matched 401(k)s or open a Roth or Traditional IRA. If you've ever heard your parents say, "Have babies," they were wrong. Starting a family is certainly a personal choice, but not one you should be making based on parental pressure. Raising a child is a tremendous financial commitment. In 2012, it cost middle-income parents $286,860 to raise a child from birth to age 17. If you're willing to pay for college in full, then you can tack on an extra $100,000 or more. For many millennials stuck in the red, starting a family could complicate an already stressful financial situation. Parents mean well, but sometimes their advice comes from a negative personal experience or a lack of knowledge. Instead of always trusting their financial advice, be sure to educate yourself and check against credible sources.

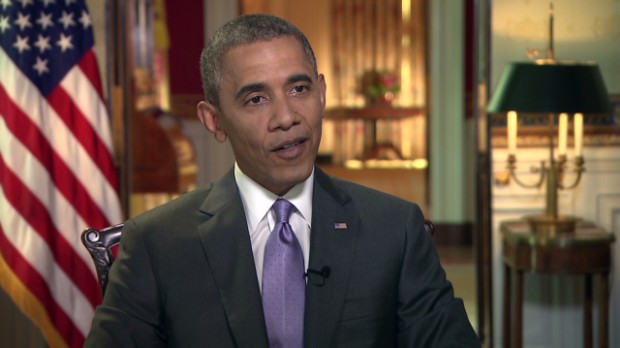

Obama: 3 ways to help working families NEW YORK (CNNMoney) The ink is barely dry on the post-crisis financial reforms, but President Obama says more is needed.

Obama: 3 ways to help working families NEW YORK (CNNMoney) The ink is barely dry on the post-crisis financial reforms, but President Obama says more is needed.  Jim West/Alamy Last week, we talked about investing, the second circle of wealth in my series of "Six Absolute Necessities for Acquiring Long-Term Wealth." The third is guaranteed income. When I study people with successful retirements, filled with abundance and options, almost all have things in common: They carry very little, if any, personal debt. They have stable, secure income from multiple sources that they can set their watch by every month Starting about 10 years before they retire, they begin shifting their assets from riskier investments to low- or no-risk income assets. A mortgage is generally the biggest debt most of us have. Many argue that you should never pay off your house because the equity you put into it is tied up and not making you money. They might recommend borrowing as much as you can now because interest rates are low. I say you can have the best of both worlds. First, pay off your mortgage before you retire. By adding small amounts directed to your principle every month, you will take months, even years off your payoff date. When your house is paid off, get the biggest equity line of credit you can. This way, if you see an attractive investment opportunity, you can put your equity to use, and if you don't, you have removed the pressure of a big mortgage payment in retirement. If you can pay off your mortgage while you are working, why not now shift that payment over to a solid savings or income product? This could work out to tens of thousands of extra dollars producing monthly income for when you retire. An abundant retirement is about strong positive cash flow that you can count on for years to come. Do you have any idea how much money you need to retire every month? Do you know where you can get that income from? Do you have enough money for home health care or long-term care? Are you protected from big market downturns during your retirement years? How much will inflation eat into that monthly income needed? Can You Answer These Questions? All these questions must be part of an income plan. We calculate these for clients all over the country. First, know how much income you and your spouse will receive from Social Security when you retire. You can get an estimate from the Social Security Administration. If you believe that number is at risk because of issues with Social Security, you better start putting more away and growing it safely. If you need $5,000 per month to retire and the Social Security for you and your spouse is only $3,500, then you have a $1,500 shortfall. Do you have a pension? How much will that be when you begin to draw it? Do you have a 401(k) or Individual Retirement Account? How long could that account last if you need to draw $1,500 a month -- $18,000 in a year? Will you have to pay taxes on what you take out? If you have a 401(k) or traditional IRA, the answer is yes. If you lose 50 percent of your capital to a bear market, how long will you be able to get $18,000 per year? As you get to be in what we call the "retirement danger zone," which is 10 years before your projected retirement, you need to start shifting assets away from market risk and over to guaranteed products. A solid fixed indexed annuity with a long-term income rider might be a very good call. I wrote an article about the different types of annuities and how to purchase one that fits your needs. A lifetime income rider (state and product variations exist) will guarantee that you have a certain amount of income (depending on how much you have in your annuity and at what age you start withdrawing) for you and your spouse's life. If you live to be very old, your normal retirement funds might run out, but a lifetime income rider guarantees that income stream regardless of what happens to the underlying cash in the account. Also if you have five to 10 years, you have time for that income rider to grow. Many income riders offer 6 percent and more guaranteed growth every year. When you purchase a $200,000 annuity, many companies might offer a 10 percent bonus on your initial purchase price so your starting amount would be $220,000. When you add compound growth at 6 percent over 10 years, your income rider would top $400,000. Then you would start to draw your lifetime income at 6 percent of the $400,000, giving you $24,000 a year income for you and your spouse's life. Presto! You have filled your income gap. If you have the resources to purchase another annuity, you might get one with a cost of living clause to hedge against inflation.

Jim West/Alamy Last week, we talked about investing, the second circle of wealth in my series of "Six Absolute Necessities for Acquiring Long-Term Wealth." The third is guaranteed income. When I study people with successful retirements, filled with abundance and options, almost all have things in common: They carry very little, if any, personal debt. They have stable, secure income from multiple sources that they can set their watch by every month Starting about 10 years before they retire, they begin shifting their assets from riskier investments to low- or no-risk income assets. A mortgage is generally the biggest debt most of us have. Many argue that you should never pay off your house because the equity you put into it is tied up and not making you money. They might recommend borrowing as much as you can now because interest rates are low. I say you can have the best of both worlds. First, pay off your mortgage before you retire. By adding small amounts directed to your principle every month, you will take months, even years off your payoff date. When your house is paid off, get the biggest equity line of credit you can. This way, if you see an attractive investment opportunity, you can put your equity to use, and if you don't, you have removed the pressure of a big mortgage payment in retirement. If you can pay off your mortgage while you are working, why not now shift that payment over to a solid savings or income product? This could work out to tens of thousands of extra dollars producing monthly income for when you retire. An abundant retirement is about strong positive cash flow that you can count on for years to come. Do you have any idea how much money you need to retire every month? Do you know where you can get that income from? Do you have enough money for home health care or long-term care? Are you protected from big market downturns during your retirement years? How much will inflation eat into that monthly income needed? Can You Answer These Questions? All these questions must be part of an income plan. We calculate these for clients all over the country. First, know how much income you and your spouse will receive from Social Security when you retire. You can get an estimate from the Social Security Administration. If you believe that number is at risk because of issues with Social Security, you better start putting more away and growing it safely. If you need $5,000 per month to retire and the Social Security for you and your spouse is only $3,500, then you have a $1,500 shortfall. Do you have a pension? How much will that be when you begin to draw it? Do you have a 401(k) or Individual Retirement Account? How long could that account last if you need to draw $1,500 a month -- $18,000 in a year? Will you have to pay taxes on what you take out? If you have a 401(k) or traditional IRA, the answer is yes. If you lose 50 percent of your capital to a bear market, how long will you be able to get $18,000 per year? As you get to be in what we call the "retirement danger zone," which is 10 years before your projected retirement, you need to start shifting assets away from market risk and over to guaranteed products. A solid fixed indexed annuity with a long-term income rider might be a very good call. I wrote an article about the different types of annuities and how to purchase one that fits your needs. A lifetime income rider (state and product variations exist) will guarantee that you have a certain amount of income (depending on how much you have in your annuity and at what age you start withdrawing) for you and your spouse's life. If you live to be very old, your normal retirement funds might run out, but a lifetime income rider guarantees that income stream regardless of what happens to the underlying cash in the account. Also if you have five to 10 years, you have time for that income rider to grow. Many income riders offer 6 percent and more guaranteed growth every year. When you purchase a $200,000 annuity, many companies might offer a 10 percent bonus on your initial purchase price so your starting amount would be $220,000. When you add compound growth at 6 percent over 10 years, your income rider would top $400,000. Then you would start to draw your lifetime income at 6 percent of the $400,000, giving you $24,000 a year income for you and your spouse's life. Presto! You have filled your income gap. If you have the resources to purchase another annuity, you might get one with a cost of living clause to hedge against inflation.

REUTERS

REUTERS