Source: Coach

Coach (NYSE: COH ) , a leading distributor of luxury handbags and accessories, has seen its share price fall by more than 30% in the past 52 weeks. Currently trading at 6.5 times its trailing-twelve-month EV/EBITDA and 12.0 times its trailing-twelve-month P/E, Coach looks like a bargain for value investors. However, investors risk catching a falling knife with Coach, as recent events cast doubts over Coach's brand strength and strategy.

It's also possible to compare Coach with Hershey (NYSE: HSY ) and Vera Bradley (NASDAQ: VRA ) to gain a better understanding of its competitive advantages (or lack of them).

Brand power

Almost every consumer company will say it has strong brands, if asked. The difference between strong and weak brands lies in market share stability and pricing power. Coach has recently disappointed on both counts.

According to Euromonitor research, Coach's share of the domestic handbag market has declined from 19% in 2011 to 17.5% in 2012. In the third quarter of fiscal 2014, Coach experienced a 21% decline in comparable-store sales, which represented the fourth consecutive quarter of negative same-store sales growth. This is a strong indication that Coach has lost further market share since 2012. It suggests that Coach's branding power isn't as strong as perceived, as competitors were able to 'steal' its loyal customers.

With respect to pricing power, the indicators are negative as well, with Coach's gross margin on a gradual decline. Coach's five-year average 2009-2013 gross margin of 72.7% falls significantly below its 2004-2008 margin of 76.4%. Furthermore, Coach announced this month that it will offer discounts on its handbags at its full-price U.S. stores. This represents a departure from its prior policy and will likely dilute its brand in the minds of consumers.

It's worth comparing Coach with Hershey, which sells another woman's favorite -- chocolate. Hershey's brand power is far superior to that of Coach, as its track record shows.

In terms of customer retention, Hershey has increased its top line in every single year of the past decade, and boasts a decent 10-year revenue compound annual growth rate of 5.5%. Its loyal customers have continued to consume chocolate, even in the depths of the 2008-2009 global financial crisis.

Hershey also has a majority share (44.5% in 2013) of the U.S. chocolate market, with 1.5 times and seven times the market shares of the second-largest and third-largest players, respectively. Its revenue resilience and superiority in market share offer the strongest evidence of Hershey's ability to keep customers coming back.

Hershey also boasts significant pricing power. It has expanded its gross margin by 1,290 basis points to 45.9% since 2007, while raising product prices in 2002, 2008, and 2011. Moreover, private label's 3.2% share of the domestic confectionery market suggests that pricing hasn't played a significant part in consumers' purchasing decisions for chocolate.

Using Hershey as an example, the analysis suggests that there are other consumer companies with better brands in the market, apart from Coach.

Source: Coach

Brand extension

In the face of falling handbag sales, Coach has attempted to broaden its appeal by diversifying its product portfolio. Footwear, men's accessories, women's apparel, sunglasses, and watches are among some of Coach's new additions. While Coach can derive limited cost synergies in some of these categories due to its sourcing capabilities in leather, it has limited revenue synergies.

As Coach is traditionally known for its handbag and accessories brand, diversifying beyond its core products might confuse and even alienate its loyal supporters. More importantly, most of these products such as footwear and women's apparel carry significantly higher fashion risk, compared with accessories which are largely complementary in nature.

Coach could take some advice from its handbag & accessories peer Vera Bradley. Vera Bradley delivered a disappointing set of results for fiscal 2014 with flat revenue growth and a 14.6% drop in earnings. Vera Bradley's brand extension efforts contributed to this. In recent years, Vera Bradley has extended its brand to products such as office stationery, infant wear, and glasses. As a result, its brand became diluted and its positioning as a luxury handbag & accessories company suffered.

In response, Vera Bradley has embarked on a SKU rationalization exercise in the second quarter of fiscal 2014. The initial results have been impressive, with the summer SKU count down by 30% this year. Looking ahead, Vera Bradley is targeting a 35% reduction in SKUs for 2015. In my opinion, Coach is committing some of the mistakes that Vera Bradley made earlier, by stretching its brand too thinly.

Foolish final thoughts

There are very few companies with sustainable competitive advantages in retail, particularly in luxury fashion where consumer preferences are constantly evolving. Coach doesn't seem to be the exception. Coach's brand hasn't deterred competitors successfully in recent times and the brand looks likely to be diluted in the future with brand extension efforts. Notwithstanding its low valuation, I will advise investors to avoid Coach.

Will this stock be your next multi-bagger?

If Coach's recent share price decline leads you to think it's the next multi-bagger, you could be in for a disappointment. Give us five minutes and we'll show how you could own the best stock for 2014. Every year, The Motley Fool's chief investment officer hand-picks one stock with outstanding potential. But it's not just any run-of-the-mill company. It's a stock perfectly positioned to cash in on one of the upcoming year's most lucrative trends. Last year his pick skyrocketed 134%. And previous top picks have gained upwards of 908%, 1,252% and 1,303% over the subsequent years! Believe me, you don't want to miss what could be his biggest winner yet! Just click here to download your free copy of "The Motley Fool's Top Stock for 2014" today.

Reuters

Reuters  Related CALM Tyson Foods Sells Part Of Its Chicken Business; Dollar Tree Buys Family Dollar Monday Morning Earnings Reports Related SFTBY Softbank Reportedly Offers $32.00/Share for Dreamworks Animation Benzinga's M&A Chatter for Thursday August 28, 2014

Related CALM Tyson Foods Sells Part Of Its Chicken Business; Dollar Tree Buys Family Dollar Monday Morning Earnings Reports Related SFTBY Softbank Reportedly Offers $32.00/Share for Dreamworks Animation Benzinga's M&A Chatter for Thursday August 28, 2014  Bloomberg News

Bloomberg News

Mary Barra's bumpy ride as GM CEO NEW YORK (CNNMoney) General Motors is defending its estimate that 13 deaths can be tied to the faulty ignition switch in millions of recalled cars.

Mary Barra's bumpy ride as GM CEO NEW YORK (CNNMoney) General Motors is defending its estimate that 13 deaths can be tied to the faulty ignition switch in millions of recalled cars.

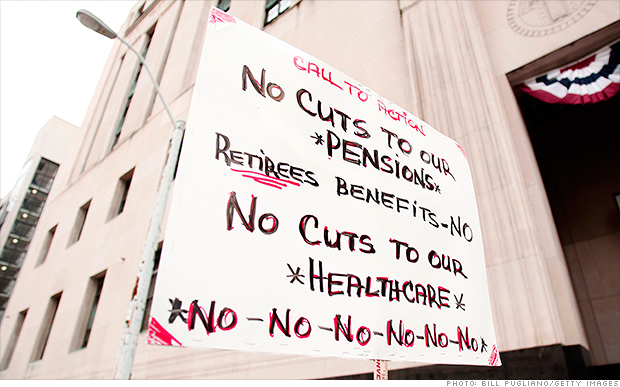

Detroit tries to rise again

Detroit tries to rise again  Alamy McDonald's (MCD) may recently have struggled to lure customers, but it still does far more business at each location than rival burger chains. The average McDonald's restaurant in the U.S. drew $2.6 million in revenue last year. Average sales for No. 2 chain Burger King (BKW): $1.2 million, according to data from its largest franchisee, Carrols Restaurant Group (TAST). What accounts for this more-than-a-million gap? "Everything from marketing and site selection to product initiatives and franchisee selection have been historical factors," said Nick Setyan, vice president in charge of equity research at Wedbush Securities, in an email. Here are four factors that drive higher sales volumes at McDonald's: 1. McDonald's gets more customers during off-peak hours. Look no further than the strength of its breakfast business relative that of Burger King, says Darren Tristano, executive vice president at restaurant consultancy Technomic. Egg McMuffin is part of the fast-food vocabulary in a way Burger King can't match. And beverage and snack offerings such as McCafe and wraps have helped increase McDonald's sales between meals. The dramatic impact from off-peak business explains why chains such as Taco Bell (YUM) are entering the battle for morning customers, while others such as Starbucks (SBUX) are seeking more afternoon and evening business. 2. The power of the Happy Meal. McDonald's has the largest share of kids meal sales in the fast-food industry and gets about 10 percent of total sales from Happy Meals, the most commonly advertised child-oriented fast-food item on television. Burger King, meanwhile, is still trying to win back "parties with kids and seniors and women," said Josh Kobza, Burger King's chief financial officer, at a conference last year. One way to do that: "We got rid of the creepy king character that tended to scare away women and children." 3. McDonald's has an edge on efficiency. Despite recent operational challenges at McDonald's, which have slowed down service, it is still more efficient. Its drive-through service can handle more cars at peak times, Tristano says, and McDonald's restaurants are adding a third service window to get customers through even faster. The average service time at McDonald's drive-throughs is 189.49 seconds, compared to 198.48 at Burger King, according to QSR Magazine. Drive-through service is important: Burger King franchisee Carrols gets 65 percent of its sales from the drive-through. 4. More marketing dollars. McDonald's spends a lot more on marketing than competitors, as Tristano points out. Its advertising costs in 2012 were $787.5 million vs. Burger King's $48.3 million, and the gap widened last year when Burger King itself spent only a few million on advertising in order to focus on equipment updates. In its 10-K submission, Burger King said it expects to spend less on advertising until 2016; the company declined to comment for this story. -.

Alamy McDonald's (MCD) may recently have struggled to lure customers, but it still does far more business at each location than rival burger chains. The average McDonald's restaurant in the U.S. drew $2.6 million in revenue last year. Average sales for No. 2 chain Burger King (BKW): $1.2 million, according to data from its largest franchisee, Carrols Restaurant Group (TAST). What accounts for this more-than-a-million gap? "Everything from marketing and site selection to product initiatives and franchisee selection have been historical factors," said Nick Setyan, vice president in charge of equity research at Wedbush Securities, in an email. Here are four factors that drive higher sales volumes at McDonald's: 1. McDonald's gets more customers during off-peak hours. Look no further than the strength of its breakfast business relative that of Burger King, says Darren Tristano, executive vice president at restaurant consultancy Technomic. Egg McMuffin is part of the fast-food vocabulary in a way Burger King can't match. And beverage and snack offerings such as McCafe and wraps have helped increase McDonald's sales between meals. The dramatic impact from off-peak business explains why chains such as Taco Bell (YUM) are entering the battle for morning customers, while others such as Starbucks (SBUX) are seeking more afternoon and evening business. 2. The power of the Happy Meal. McDonald's has the largest share of kids meal sales in the fast-food industry and gets about 10 percent of total sales from Happy Meals, the most commonly advertised child-oriented fast-food item on television. Burger King, meanwhile, is still trying to win back "parties with kids and seniors and women," said Josh Kobza, Burger King's chief financial officer, at a conference last year. One way to do that: "We got rid of the creepy king character that tended to scare away women and children." 3. McDonald's has an edge on efficiency. Despite recent operational challenges at McDonald's, which have slowed down service, it is still more efficient. Its drive-through service can handle more cars at peak times, Tristano says, and McDonald's restaurants are adding a third service window to get customers through even faster. The average service time at McDonald's drive-throughs is 189.49 seconds, compared to 198.48 at Burger King, according to QSR Magazine. Drive-through service is important: Burger King franchisee Carrols gets 65 percent of its sales from the drive-through. 4. More marketing dollars. McDonald's spends a lot more on marketing than competitors, as Tristano points out. Its advertising costs in 2012 were $787.5 million vs. Burger King's $48.3 million, and the gap widened last year when Burger King itself spent only a few million on advertising in order to focus on equipment updates. In its 10-K submission, Burger King said it expects to spend less on advertising until 2016; the company declined to comment for this story. -.

Alamy CHICAGO -- It's an assertion that has been accepted as fact by droves of the unemployed: Older people remaining on the job later in life are stealing jobs from young people. One problem, many economists say: It isn't supported by a wisp of fact. "We all cannot believe that we have been fighting this theory for more than 150 years," said April Yanyuan Wu, a research economist at the Center for Retirement Research at Boston College, who co-authored a paper last year on the subject. The commonly accepted vision of a surge of workers looks like this: A young post-doctoral student dreams of a full-time teaching job at their university, but there are no openings. An 80-something professor who has remained on the job long past what's considered "normal" retirement is blamed, The problem with that vision is that there are probably full-time teaching positions available elsewhere, or the person blocking the young grad student from the job is only 40 years old, economists say. Further, the veteran professor's decision to stay employed and productive may stir other job growth. He may bring research grants to his university allowing for other hiring, may take on assistants, and may be able to dine out and shop and fuel the economy more than if he weren't on the job. None of that would have happened had he retired. The theory Wu and other economists are fighting is known as "lump of labor," and it has maintained traction in the U.S., particularly in a climate of high unemployment. The theory dates to 1851 and says if a group enters the labor market -- or in this case, remains in it beyond their normal retirement date -- others will be unable to gain employment or will have their hours cut. It's a line of thinking that has been used in the U.S. immigration debate and in Europe to validate early retirement programs, and it relies on a simple premise: That there are a fixed number of jobs available. In fact, most economists dispute this. When women entered the workforce, there weren't fewer jobs for men. The economy simply expanded. The same is true with older workers, they argue. "There's no evidence to support that increased employment by older people is going to hurt younger people in any way," said Alicia Munnell, director of the Center for Retirement Research and the co-author with Wu of "Are Aging Baby Boomers Squeezing Young Workers Out of Jobs?" " It's not going to reduce their wages, it's not going to reduce their hours, it's not going to do anything bad to them," Munnell said. Still, many remain unconvinced. James Galbraith, a professor of government at the University of Texas at Austin, has advocated for a temporary lowering of the age to qualify for Social Security and Medicare to allow older workers who don't want to remain on the job a way to exit and to spur openings for younger workers. He doesn't buy the comparison of older workers to women entering the workforce, and says others' arguments on older workers expanding the economy don't make sense when there are so many unemployed people. If there was a surplus of jobs, he said, there would be no problem with people working longer. But there isn't. "I can't imagine how you could refute that. The older worker retires, the employer looks around and hires another worker," he said. "It's like refuting elementary arithmetic." The perception has persisted, from prominent stories in The New York Times, Newsweek and other media outlets, to a pointed question to Rep. Nancy Pelosi (D-Calif.) last year by the NBC reporter Luke Russert, who asked whether her refusal to step out of the House leadership (and the similar decisions of other older lawmakers) was denying younger politicians a chance. A chorus of lawmakers around Pelosi muttered and shouted "discrimination," until the Democratic leader chimed in herself. "Let's for a moment honor it as a legitimate question, although it's quite offensive," she said. "But you don't realize that, I guess." The heart of Russert's question makes sense to many: If Pelosi doesn't give up her position, a younger person doesn't have a chance to take it. That viewpoint is repeated in countless workplaces around the country, where a younger person awaits a senior employee's departure for their chance to ascend. In the microeconomic view of things, Pelosi remaining in her job at the age of 73 does deny others her district's seat in Congress or a chance to ascend to the leadership. But economists say the larger macroeconomic view gives a clearer picture: Having older people active and productive actually benefits all age groups, they say, and spurs the creation of more jobs. Munnell and Wu analyzed Current Population Survey data to test for any changes in employment among those under 55 when those 55 and older worked in greater numbers. They found no evidence younger workers were losing work and in fact found the opposite: Greater employment, reduced unemployment and yielded higher wages. Munnell said, outside of economists, the findings can be hard for people to understand when they think only of their own workplace. "They just could not get in their heads this dynamism that is involved," she said. "You can't extrapolate from the experience of a single company to the economy as a whole." Melissa Quercia, 35, a controller for a small information technology company in Phoenix, said she sees signs of the generational job battle all around her: Jobs once taken by high schoolers now filled by seniors, college graduates who can't find work anywhere, the resulting dearth of experience of younger applicants. She doesn't see economists' arguments playing out. Older people staying on the job aren't spurring new jobs, because companies aren't investing in creating new positions, she said. "It's really hard to retire right now, I understand that," she said. "But if the younger generation doesn't have a chance to get their foot in the door, then what?" Jonathan Gruber, an economist at the Massachusetts Institute of Technology who edited a book on the subject for the National Bureau of Economic Research, said it's a frustrating reality of his profession: That those things he knows as facts are disputed by the populace. "If you polled the average American they probably would think the opposite," he said. "There's a lot of things economists say that people don't get and this is just one of them."

Alamy CHICAGO -- It's an assertion that has been accepted as fact by droves of the unemployed: Older people remaining on the job later in life are stealing jobs from young people. One problem, many economists say: It isn't supported by a wisp of fact. "We all cannot believe that we have been fighting this theory for more than 150 years," said April Yanyuan Wu, a research economist at the Center for Retirement Research at Boston College, who co-authored a paper last year on the subject. The commonly accepted vision of a surge of workers looks like this: A young post-doctoral student dreams of a full-time teaching job at their university, but there are no openings. An 80-something professor who has remained on the job long past what's considered "normal" retirement is blamed, The problem with that vision is that there are probably full-time teaching positions available elsewhere, or the person blocking the young grad student from the job is only 40 years old, economists say. Further, the veteran professor's decision to stay employed and productive may stir other job growth. He may bring research grants to his university allowing for other hiring, may take on assistants, and may be able to dine out and shop and fuel the economy more than if he weren't on the job. None of that would have happened had he retired. The theory Wu and other economists are fighting is known as "lump of labor," and it has maintained traction in the U.S., particularly in a climate of high unemployment. The theory dates to 1851 and says if a group enters the labor market -- or in this case, remains in it beyond their normal retirement date -- others will be unable to gain employment or will have their hours cut. It's a line of thinking that has been used in the U.S. immigration debate and in Europe to validate early retirement programs, and it relies on a simple premise: That there are a fixed number of jobs available. In fact, most economists dispute this. When women entered the workforce, there weren't fewer jobs for men. The economy simply expanded. The same is true with older workers, they argue. "There's no evidence to support that increased employment by older people is going to hurt younger people in any way," said Alicia Munnell, director of the Center for Retirement Research and the co-author with Wu of "Are Aging Baby Boomers Squeezing Young Workers Out of Jobs?" " It's not going to reduce their wages, it's not going to reduce their hours, it's not going to do anything bad to them," Munnell said. Still, many remain unconvinced. James Galbraith, a professor of government at the University of Texas at Austin, has advocated for a temporary lowering of the age to qualify for Social Security and Medicare to allow older workers who don't want to remain on the job a way to exit and to spur openings for younger workers. He doesn't buy the comparison of older workers to women entering the workforce, and says others' arguments on older workers expanding the economy don't make sense when there are so many unemployed people. If there was a surplus of jobs, he said, there would be no problem with people working longer. But there isn't. "I can't imagine how you could refute that. The older worker retires, the employer looks around and hires another worker," he said. "It's like refuting elementary arithmetic." The perception has persisted, from prominent stories in The New York Times, Newsweek and other media outlets, to a pointed question to Rep. Nancy Pelosi (D-Calif.) last year by the NBC reporter Luke Russert, who asked whether her refusal to step out of the House leadership (and the similar decisions of other older lawmakers) was denying younger politicians a chance. A chorus of lawmakers around Pelosi muttered and shouted "discrimination," until the Democratic leader chimed in herself. "Let's for a moment honor it as a legitimate question, although it's quite offensive," she said. "But you don't realize that, I guess." The heart of Russert's question makes sense to many: If Pelosi doesn't give up her position, a younger person doesn't have a chance to take it. That viewpoint is repeated in countless workplaces around the country, where a younger person awaits a senior employee's departure for their chance to ascend. In the microeconomic view of things, Pelosi remaining in her job at the age of 73 does deny others her district's seat in Congress or a chance to ascend to the leadership. But economists say the larger macroeconomic view gives a clearer picture: Having older people active and productive actually benefits all age groups, they say, and spurs the creation of more jobs. Munnell and Wu analyzed Current Population Survey data to test for any changes in employment among those under 55 when those 55 and older worked in greater numbers. They found no evidence younger workers were losing work and in fact found the opposite: Greater employment, reduced unemployment and yielded higher wages. Munnell said, outside of economists, the findings can be hard for people to understand when they think only of their own workplace. "They just could not get in their heads this dynamism that is involved," she said. "You can't extrapolate from the experience of a single company to the economy as a whole." Melissa Quercia, 35, a controller for a small information technology company in Phoenix, said she sees signs of the generational job battle all around her: Jobs once taken by high schoolers now filled by seniors, college graduates who can't find work anywhere, the resulting dearth of experience of younger applicants. She doesn't see economists' arguments playing out. Older people staying on the job aren't spurring new jobs, because companies aren't investing in creating new positions, she said. "It's really hard to retire right now, I understand that," she said. "But if the younger generation doesn't have a chance to get their foot in the door, then what?" Jonathan Gruber, an economist at the Massachusetts Institute of Technology who edited a book on the subject for the National Bureau of Economic Research, said it's a frustrating reality of his profession: That those things he knows as facts are disputed by the populace. "If you polled the average American they probably would think the opposite," he said. "There's a lot of things economists say that people don't get and this is just one of them."

) announced that its board of directors has approved an executive management succession plan.

) announced that its board of directors has approved an executive management succession plan.