HomeAway (NASDAQ: AWAY ) -- a leading online marketplace for vacation rentals worldwide -- reported second-quarter results after the market closed last Thursday churning in solid top-line, listings, and free cash flow growth. In addition, the company unveiled a new marketing strategy aimed to drive growth in the coming years.

Highlights from a strong quarter

Total revenue for HomeAway increased 31.9% year-over-year to $114.3 million, of which listing revenue increased 28.7% to $114.3 million. Most notably, however, was the significant growth in HomeAway's "other revenue" segment, which grew 49.7% year-over-year to $19.7 million thanks to increased customer adoption of the company's owner, manager, and traveler product add-ons.

Average revenue per subscription listing was $473 in the quarter, a year-over-year increase of 13.7%, boosted in large part by the increased adoption of HomeAway's add-on products. Paid listings at the end of the second quarter totaled 1.04 million, up 34.2% year-over-year. Approximately 72% of these were subscription listings (paid in advance by property owners), with the remaining 28% made up of performance-based listings (where property owners only pay commissions on traveler bookings, fees, or traveler inquiries).

HomeAway's performance held up closer to the bottom line as well, as adjusted EBITDA increased 32.7% year-over-year to $33 million. Meanwhile, operating cash flow expanded 110.6% year-over-year to $45.9 million.

The renewal rate of HomeAway's subscription listings was 72.8% at the end of the second quarter, up slightly from the 72.4% renewal rate at the end of the second quarter in 2013 but still down from the 73.1% renewal rate at the end of the first quarter of 2014. "Renewal rates in the U.S. are steady," said co-founder and CEO Brian Sharples, "while Europe has seen some pressure in a few markets."

Finally, HomeAway's websites attracted 229.5 million visits during the quarter, an increase of 14.2% year-over-year. This was a strong quarter for HomeAway in terms of growth of revenue, revenue per subscription, and overall paid listings.

An expanding marketing strategy

On July 24, the same day second-quarter earnings were released, HomeAway announced the hiring of Mariano Dima as chief marketing officer -- a new executive position at HomeAway. Dima brings more than 20 years of experience with Visa Europe, PepsiCo Latin America, Levi Strauss & Co., and Vodafone. In the second quarter conference call, Sharples shared his vision for what Dima brings to the table for HomeAway:

Mariano is a seasoned marketing leader who understands the value of developing a consistent and impactful global integrated marketing program to enhance traffic, brand awareness and conversion, including a combination of brand advertising, performance marketing, SEO [search engine optimization], PR and database marketing. He's also highly experienced globally and particularly in Europe, which is one of our most important and certainly one of our most competitive markets.

In 2013, Europe accounted for 36.5% of HomeAway's total sales. An across-the-board expansion of HomeAway's marketing efforts, guided by Dima, will be taking place over the next several years. The reasoning behind this, as shared by Sharples on the conference call, is that over the past several years HomeAway has particularly focused on investing in the development of its vacation rental formula and technology. "With much of that work behind us," said Sharples, "we're now planning to invest a good portion of that operating leverage in integrated marketing."

Dima -- who officially comes on board as chief marketing officer in September -- will help develop an integrated marketing strategy aimed to expand HomeAway's brand equity, improve customer conversion, and increase customer traffic in a profitable manner. Sharples believes that this marketing campaign can occur without denting HomeAway's margins in a significant way, although he did warn that the company may see some margin compression in the second part of 2014 and 2015.

The key question for investors is whether these ramped up marketing initiatives will lead to strong top-line and bottom-line growth. Remember that Sharples has been with HomeAway as co-founder and CEO since 2004. Carl Shepherd, HomeAway's second co-founder, also remains with the company as chief strategy & development officer. These two have been with HomeAway for the long haul since the company's inception, and I don't anticipate that changing anytime soon. There is a long-term vision and strategy at work here.

Foolish final thoughts

HomeAway's mission, in the words of Sharples, is "to make booking a vacation rental as easy as booking a hotel." There is no question that the business itself continues to expand in the areas that count, including listings and revenue per subscription. HomeAway carries a total of $792.5 million in cash and short-term investments, well offsetting the $307.4 million of debt on the company's books, providing ample fuel for the company to continue its expansion strategy in the coming years.

HomeAway has built an effective platform, now with over 1 million total listings, that appears poised to expand even further thanks to a coordinated marketing effort set to take off in the remaining months of 2014. Investors will want to watch closely to be sure that these marketing efforts are indeed paying off with higher sales growth, listings, and revenue per subscription in the coming years.

Based on the stock's nearly 9% jump following earnings, the market certainly liked what it saw this quarter. While the stock looks somewhat pricey trading at a price/sales ratio around 8, should the company's marketing strategy succeed HomeAway will likely be able to deliver market-beating returns to investors over the next three to five years.

More from The Motley Fool: Warren Buffett Tells You How to Turn $40 into $10 Million

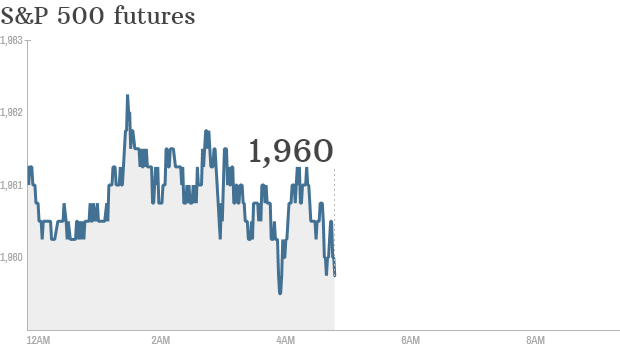

Click on chart for more premarket data. LONDON (CNNMoney) There's only one game in town Wednesday (apart from the Brazil blame game) and that's the latest insight into Federal Reserve thinking on interest rates.

Click on chart for more premarket data. LONDON (CNNMoney) There's only one game in town Wednesday (apart from the Brazil blame game) and that's the latest insight into Federal Reserve thinking on interest rates.

Jasper Juinen/Bloomberg via Getty Images Philips is to merge its lighting components businesses into a separate unit worth up to 2 billion euros ($2.7 billion), which may be listed -- a major step in its ongoing strategy to refocus on health care and high-end lighting systems. Under Chief Executive Officer Frans van Houghton, the Dutch company is reinventing itself after its TV, audio and video businesses struggled for years to compete with low-cost Asian rivals and prompted a spate of profit warnings at the firm. It has sold off its television business, cut more than 5,000 jobs and concentrated on growing its health care products. Now Philips, which started out 120 years ago as a pioneer in electric lighting, wants to narrow its focus in that area, too -- to large, complex lighting systems rather than LEDs, under pressure from a severe price war. The market for LEDs is booming as the world switches from incandescent light bulbs, now banned in most places, to more efficient and durable lights. But a price war for LED bulbs is hurting profits, leaving Philips and German rival Osram -- spun off from its parent company Siemens last July -- scrambling to develop new technology and seek out new market segments. By spinning off its Lumileds and its automotive lighting businesses, which had combined sales of 1.4 billion euros ($1.9 billion) last year, Philips said the unit would be better placed to compete for new business from outside customers who currently regard the Philips group as a competitor. It also said it would look for outside equity or debt investors into the new business to help it expand its capacity, with an initial public offering one of the options. "As a strong standalone company they will have increased flexibility to attract investments and customers to accelerate growth and to exploit scale," van Houten, who took the helm of the group in 2011, said in a telephone briefing. Analysts said it was a smart move that would make Philips a more manageable and profitable business. "It is definitely positive. It's a logical step in the strategy and will shore up their earnings quality," said Volker Stoll of Landesbank Baden-Wuerttemberg, adding that Philips appeared to be preparing the unit for an eventual sale. "The margins will get lifted and the return on capital expenditure will also increase," he said. "It's good news as this issues was looming for quite some time." New Frontier? Osram, which analysts say is weaker than Philips's new division in the field of LED lighting, has performed strongly since being spun off. Its shares have gained nearly 50 percent during a period when the German mid-cap index rose only 21 percent. Shares in Philips were up 3.2 percent shortly after the announcement. The company didn't give a valuation for the new business, but ING analyst Robin van de Broek estimated it could be worth about 2 billion euros. Osram trades at a multiple of 0.7 times price per share and Epistar, a Taiwanese rival which is more focused on LED manufacture, at 3.6 times price per share. The as yet unnamed new business will combine elements resembling each of the two companies. The spun-off lighting business will make components such as bulbs, auto headlights and high-powered LED lamps. It will count BMW, Volkswagen and the latter's Audi marque among its automotive clients. Some analysts say LED car headlights, with their promise of higher premiums for the manufacturer, better fuel efficiency and more natural illumination of the road, are the next frontier for LED lighting technology. Philips said the spin-off of the subsidiary, in which it could envisage holding a minority stake, should be completed by the first half of 2015, and cost Philips 30 million euros. Philips' remaining lighting unit -- which provides large lighting systems and services as well as light fittings and lamps for the professional and consumer markets -- will be a major customer of the separate company. The new business, which will be headed by Lumileds chief executive Pierre-Yves Lesaicherre, will also continue to collaborate with Philips lighting on research and development. -.

Jasper Juinen/Bloomberg via Getty Images Philips is to merge its lighting components businesses into a separate unit worth up to 2 billion euros ($2.7 billion), which may be listed -- a major step in its ongoing strategy to refocus on health care and high-end lighting systems. Under Chief Executive Officer Frans van Houghton, the Dutch company is reinventing itself after its TV, audio and video businesses struggled for years to compete with low-cost Asian rivals and prompted a spate of profit warnings at the firm. It has sold off its television business, cut more than 5,000 jobs and concentrated on growing its health care products. Now Philips, which started out 120 years ago as a pioneer in electric lighting, wants to narrow its focus in that area, too -- to large, complex lighting systems rather than LEDs, under pressure from a severe price war. The market for LEDs is booming as the world switches from incandescent light bulbs, now banned in most places, to more efficient and durable lights. But a price war for LED bulbs is hurting profits, leaving Philips and German rival Osram -- spun off from its parent company Siemens last July -- scrambling to develop new technology and seek out new market segments. By spinning off its Lumileds and its automotive lighting businesses, which had combined sales of 1.4 billion euros ($1.9 billion) last year, Philips said the unit would be better placed to compete for new business from outside customers who currently regard the Philips group as a competitor. It also said it would look for outside equity or debt investors into the new business to help it expand its capacity, with an initial public offering one of the options. "As a strong standalone company they will have increased flexibility to attract investments and customers to accelerate growth and to exploit scale," van Houten, who took the helm of the group in 2011, said in a telephone briefing. Analysts said it was a smart move that would make Philips a more manageable and profitable business. "It is definitely positive. It's a logical step in the strategy and will shore up their earnings quality," said Volker Stoll of Landesbank Baden-Wuerttemberg, adding that Philips appeared to be preparing the unit for an eventual sale. "The margins will get lifted and the return on capital expenditure will also increase," he said. "It's good news as this issues was looming for quite some time." New Frontier? Osram, which analysts say is weaker than Philips's new division in the field of LED lighting, has performed strongly since being spun off. Its shares have gained nearly 50 percent during a period when the German mid-cap index rose only 21 percent. Shares in Philips were up 3.2 percent shortly after the announcement. The company didn't give a valuation for the new business, but ING analyst Robin van de Broek estimated it could be worth about 2 billion euros. Osram trades at a multiple of 0.7 times price per share and Epistar, a Taiwanese rival which is more focused on LED manufacture, at 3.6 times price per share. The as yet unnamed new business will combine elements resembling each of the two companies. The spun-off lighting business will make components such as bulbs, auto headlights and high-powered LED lamps. It will count BMW, Volkswagen and the latter's Audi marque among its automotive clients. Some analysts say LED car headlights, with their promise of higher premiums for the manufacturer, better fuel efficiency and more natural illumination of the road, are the next frontier for LED lighting technology. Philips said the spin-off of the subsidiary, in which it could envisage holding a minority stake, should be completed by the first half of 2015, and cost Philips 30 million euros. Philips' remaining lighting unit -- which provides large lighting systems and services as well as light fittings and lamps for the professional and consumer markets -- will be a major customer of the separate company. The new business, which will be headed by Lumileds chief executive Pierre-Yves Lesaicherre, will also continue to collaborate with Philips lighting on research and development. -.