The prices of many precious metals fell last week after Federal Reserve Chairman Ben Bernanke’s announcements regarding the Fed’s projected end to quantitative easing (QE) by the middle of 2014. And they are continuing their weakening trend this week, bringing ETFs and other metals-themed products down to levels that that some analysts are pointing to as good buying opportunities for investors.

The general outlook of gold and silver prices, says ETF Securities Research, should stay negative while interest-rate expectations keep rising and the U.S. dollar continues to improve. This means there are plenty of “reasons for contrarian investors to look favorably on precious metals,” wrote analysts Nitesh Shah and Nicholas Brooks in their outlook report on Friday for ETF Securities.

“At current levels gold, silver, platinum and palladium are estimated to be trading around or below their respective marginal costs of production,” they said.

“Therefore, while further downside in the short-term is possible, investors with longer-term time horizons may start to look at the recent sell-off as a longer-term accumulation opportunity,” Shan and Brooks emphasized.

Low and Lower

Gold prices dropped 7% last week, 5% for the month, 20% for three months and 18% for the past 12 months, according to Bloomberg data cited by ETF Securities. Meanwhile, silver fell even more — declining 8%, 11%, 31% and 29% during the same period.

Prices on platinum and palladium also have moved down, but not as dramatically.

Platinum decreased 6% last week, 6% for the past month, 14% for the past three months and 6% over the last 12 months. Palladium dropped 8% last week, 9% in the past 30 days and 12% in last 90 days, but is up 9% for the 12-month period.

“As long as the Fed continues to reaffirm its commitment to reduce QE in the coming months, it seems likely that gold prices will remain weak,” the ETF Securities analysts said in their report.

But there are several factors that could change hurt U.S. growth, they add, and such a shift might prompt the Fed to step back from QE reductions. “With gold positioning so negative, this has the potential to stimulate a strong short-covering gold price move,” the analysts wrote.

Frank Holmes, CEO and chief investment officer of U.S. Global Investors, said before the Fed’s latest announcement that he had expected a 10% drop in gold prices, but he also notes the potential for a 30% move on the upside over the next 18 months.

Platinum, Palladium

The recent price drops of these metals is likely associated with a more general move by investors away from “risky” cyclical assets “in reaction to expected reduced liquidity injections by the U.S. Fed later this year,” Shah and Brooks say.

“In our view, however, to the degree that the Fed ultimately reduces its easing policy because of continued recovery of the U.S. economy," they conclude, "both platinum and palladium should benefit.”

ETF Efforts

As metals prices have moved down in the past 12 months, metal-themed ETFs — of course — have declined as well.

The SPDR Gold Shares ETF (GLD) has seen large outflows. GLD fell roughly 12% in the past 30 days, about 23.5% year to date and 19% in the last 12 months.

The iShares Silver Trust ETF (SLV) has fallen roughly 7.5% for the month, 35% year to date and 28% in the past 12 months.

---

For direct insights on the role of ETFs in client portfolios from multiple experts—including Rick Ferri, Ron Delegge, Skip Schweiss and more—we invite you to register for AdvisorOne’s premiere advisorcentric Virtual ETF Summit, which starts July 23 (and get multiple hours of CFP Board CE).

Getty Images From birth, we're raised thinking mommy and daddy know best. They have our best interests in mind when they scare away tattooed teenage boys, keep the liquor under lock and key, and set our curfews earlier than those of all our other friends. Unfortunately, when it comes to money, mommy and daddy might be leading you astray. Financial literacy rates in the Millennial generation are abysmal. This year the Treasury Department and Department of Education tested the financial literacy of 84,000 high schoolers, who scored an average of 69 percent. With little to no financial literacy taught in our education system, children have no choice but to learn from dear old Mom and Dad. But if Mom and Dad were never taught -- or never bothered to learn -- how to appropriately handle money, they sure aren't the ones who should be giving financial advice. If you've ever heard your parents say, "Don't get a credit card," they were wrong. Credit cards are one of the easiest ways to build your credit score. Granted, establishing new credit only makes up 10 percent of your score, but if you aren't paying off loans yet, it might be the only way for you to establish a line of credit. Length of credit history makes up 15 percent of your score, so the longer you've had a "healthy" history, the higher your score will typically be. Parents are often reluctant to give their college-age children access to plastic, but if you know how to treat your card right, it'll pay off. When you graduate and start looking for an apartment, a respectable credit score is important to your landlord, while a lack of one can prevent you from signing a lease. If you've ever heard your parents say, "Keep a monthly balance on your credit card," they were wrong. Somehow, parents heard a rumor that keeping a monthly balance on your credit card will help your credit score. They spout some nonsense about how paying the minimum shows responsibility and increases your score. False. Carrying a balance does nothing to improve your score and instead costs you more money because you're accumulating interest on the balance. Instead, pay off your credit card in full each month (which means not charging more to the card than you know you can afford). If you've ever heard your parents say, "X,Y or Z college is worth the student loan debt," they were wrong. Millennials are drowning in student loan debt. As a generation, our debt is so horrific it's predicted to delay our retirement age until 73. For many millennials, it's too late to turn back now; the debt has already been accumulated. The only hope is to diligently, or quickly, pay down debt, and simultaneously start figuring out how to save for retirement from the moment you get your first paycheck. The other option is to start a side hustle and increase your influx of cash. For the younger millennials and Generation Z, there's still hope. When considering college, apply to every scholarship you qualify for. Sometimes your GPA doesn't matter as much as your height or your ability to call ducks. It's a good idea to set your pride aside during your college-decision-making process and really evaluate whether the ROI of your major at X, Y or Z school is worth tens of thousands of dollars in debt. If not, consider state schools, smaller liberal-arts colleges, or simply choosing the college that offered you the best financial package. If you've ever heard your parents say, "Don't invest in the stock market; it's just gambling," they were wrong. Yes, 2008 was a tough year, and the market took a tumble. Boomers lost money and some saw their retirement accounts take a hit. Unfortunately, this led to the millennial generation developing a great mistrust of the stock market. While we might be reluctant to get in bed with the stock market, it's certainly still willing to love us. The greatest advantage for an investor is time, and time is exactly what 20- to 30-year-olds possess. If you're not quite ready for index funds, mutual funds or buying individual stocks, you should at least contribute to your company-matched 401(k)s or open a Roth or Traditional IRA. If you've ever heard your parents say, "Have babies," they were wrong. Starting a family is certainly a personal choice, but not one you should be making based on parental pressure. Raising a child is a tremendous financial commitment. In 2012, it cost middle-income parents $286,860 to raise a child from birth to age 17. If you're willing to pay for college in full, then you can tack on an extra $100,000 or more. For many millennials stuck in the red, starting a family could complicate an already stressful financial situation. Parents mean well, but sometimes their advice comes from a negative personal experience or a lack of knowledge. Instead of always trusting their financial advice, be sure to educate yourself and check against credible sources.

Getty Images From birth, we're raised thinking mommy and daddy know best. They have our best interests in mind when they scare away tattooed teenage boys, keep the liquor under lock and key, and set our curfews earlier than those of all our other friends. Unfortunately, when it comes to money, mommy and daddy might be leading you astray. Financial literacy rates in the Millennial generation are abysmal. This year the Treasury Department and Department of Education tested the financial literacy of 84,000 high schoolers, who scored an average of 69 percent. With little to no financial literacy taught in our education system, children have no choice but to learn from dear old Mom and Dad. But if Mom and Dad were never taught -- or never bothered to learn -- how to appropriately handle money, they sure aren't the ones who should be giving financial advice. If you've ever heard your parents say, "Don't get a credit card," they were wrong. Credit cards are one of the easiest ways to build your credit score. Granted, establishing new credit only makes up 10 percent of your score, but if you aren't paying off loans yet, it might be the only way for you to establish a line of credit. Length of credit history makes up 15 percent of your score, so the longer you've had a "healthy" history, the higher your score will typically be. Parents are often reluctant to give their college-age children access to plastic, but if you know how to treat your card right, it'll pay off. When you graduate and start looking for an apartment, a respectable credit score is important to your landlord, while a lack of one can prevent you from signing a lease. If you've ever heard your parents say, "Keep a monthly balance on your credit card," they were wrong. Somehow, parents heard a rumor that keeping a monthly balance on your credit card will help your credit score. They spout some nonsense about how paying the minimum shows responsibility and increases your score. False. Carrying a balance does nothing to improve your score and instead costs you more money because you're accumulating interest on the balance. Instead, pay off your credit card in full each month (which means not charging more to the card than you know you can afford). If you've ever heard your parents say, "X,Y or Z college is worth the student loan debt," they were wrong. Millennials are drowning in student loan debt. As a generation, our debt is so horrific it's predicted to delay our retirement age until 73. For many millennials, it's too late to turn back now; the debt has already been accumulated. The only hope is to diligently, or quickly, pay down debt, and simultaneously start figuring out how to save for retirement from the moment you get your first paycheck. The other option is to start a side hustle and increase your influx of cash. For the younger millennials and Generation Z, there's still hope. When considering college, apply to every scholarship you qualify for. Sometimes your GPA doesn't matter as much as your height or your ability to call ducks. It's a good idea to set your pride aside during your college-decision-making process and really evaluate whether the ROI of your major at X, Y or Z school is worth tens of thousands of dollars in debt. If not, consider state schools, smaller liberal-arts colleges, or simply choosing the college that offered you the best financial package. If you've ever heard your parents say, "Don't invest in the stock market; it's just gambling," they were wrong. Yes, 2008 was a tough year, and the market took a tumble. Boomers lost money and some saw their retirement accounts take a hit. Unfortunately, this led to the millennial generation developing a great mistrust of the stock market. While we might be reluctant to get in bed with the stock market, it's certainly still willing to love us. The greatest advantage for an investor is time, and time is exactly what 20- to 30-year-olds possess. If you're not quite ready for index funds, mutual funds or buying individual stocks, you should at least contribute to your company-matched 401(k)s or open a Roth or Traditional IRA. If you've ever heard your parents say, "Have babies," they were wrong. Starting a family is certainly a personal choice, but not one you should be making based on parental pressure. Raising a child is a tremendous financial commitment. In 2012, it cost middle-income parents $286,860 to raise a child from birth to age 17. If you're willing to pay for college in full, then you can tack on an extra $100,000 or more. For many millennials stuck in the red, starting a family could complicate an already stressful financial situation. Parents mean well, but sometimes their advice comes from a negative personal experience or a lack of knowledge. Instead of always trusting their financial advice, be sure to educate yourself and check against credible sources.

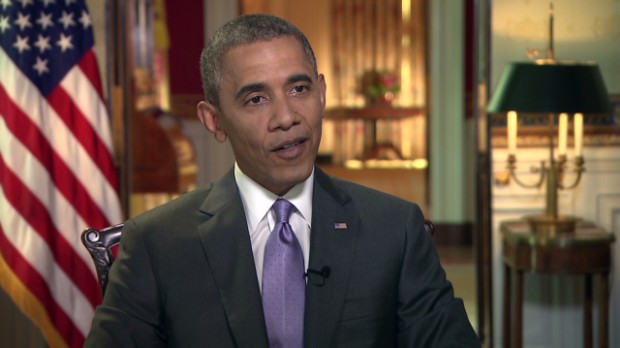

Obama: 3 ways to help working families NEW YORK (CNNMoney) The ink is barely dry on the post-crisis financial reforms, but President Obama says more is needed.

Obama: 3 ways to help working families NEW YORK (CNNMoney) The ink is barely dry on the post-crisis financial reforms, but President Obama says more is needed.