BALTIMORE (Stockpickr) -- U.S. stocks have been moving straight up for more than a month now, busting through the new highs that the S&P 500 set back in January. But that could be about to change.

>>5 Stocks With Big Insider Buying

The market's "up, up and away" trajectory has stocks hitting their heads on the top of the trading range they've been bouncing in for the last 15 months. That doesn't mean it's time to duck and cover with your stock portfolio. We're still in a "buy the dips" market -- we're just due for another dip.

But while the broad market hints at a correction, some names are still screaming "buy" right now. Today, we're taking a closer technical look at five of them.

If you're new to technical analysis, here's the executive summary.

>>Invest Like a Hedge Fund With the Pros' 5 Top Stocks

Technicals are a study of the market itself. Since the market is ultimately the only mechanism that determines a stock's price, technical analysis is a valuable tool even in the roughest of trading conditions. Technical charts are used every day by proprietary trading floors, Wall Street's biggest financial firms and individual investors to get an edge on the market. And research shows that skilled technical traders can bank gains as much as 90% of the time.

Every week, I take an in-depth look at big names that are telling important technical stories. Here's this week's look at five high-volume stocks to trade this week.

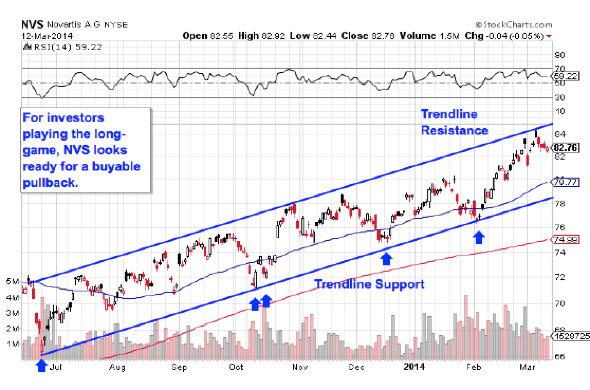

Novartis

First up is big pharma firm Novartis (NVS). Novartis has shown a huge correlation with the S&P 500 this year, so not surprisingly, it's bouncing higher in an uptrending channel of its own. That makes NVS a perfect example of how to trade this sort of "buy the dips" market.

>>5 Hated Earnings Stocks You Should Love

You don't have to be an expert technical analyst to figure out what's going on in NVS -- a quick glance at this chart tells you everything you need to know. NVS has been bouncing between a pair of parallel trend lines since back in the summer; those lines are the high-probability range for shares of Novartis to keep bouncing in between. So, as shares slide off of trend line resistance, patient investors are coming up on a sixth buying opportunity in this channel when NVS comes down to test support.

It's important not to be early on the NVS trade. The bounce off of support is likely to coincide with a support bounce in the S&P 500 -- that'll be an ideal buying opportunity since it'll synch up a buy signal in NVS with a buy signal in "stocks in general" later this month. Keep an eye on the bottom of the channel.

Micron Technology

Flash memory stock Micron Technology (MU) has been the poster child for large-cap momentum stocks over the last year, rallying a staggering 170% in the last 12 months alone. MU is another uptrending channel trade on our list today. And for traders who don't want to wait for NVS to test support, Micron is offering up a support bounce of its own this week.

>>2 Big Tech Stocks to Trade (or Not)

Waiting to buy off a support bounce makes sense for two big reasons: It's the spot where shares have the furthest to move up before they hit resistance, and it's the spot where the risk is the least (because shares have the least room to move lower before you know you're wrong). Remember, all trend lines do eventually break, but by actually waiting for the bounce to happen first, you're ensuring MU can actually still catch a bid along that line.

Most important of all, relative strength continues to look stellar in MU. That means that this name continues to outperform the broad market through every price swing. As the S&P starts looking corrective, relative strength is the single most important indicator you can put in your technical toolbox today.

If you buy here, recommend keeping a protective stop just under the 50-day moving average -- that level has been a stellar proxy for support all the way up.

AIG

Things have been looking a whole lot less interesting in global insurance giant AIG (AIG). This $73 billion financial firm is a whopping 1.3% higher than it was six months ago, drastically underperforming the S&P's 11% rise over that same period. But that sideways slug is exactly what makes AIG tradable now.

>>3 Huge Stocks on Traders' Radars

AIG is forming a rectangle pattern, a price setup that's formed by a pair of horizontal resistance and support levels that basically "box in" shares. For AIG, the levels to watch are $52 and $47. A breakout through the top of the pattern at $52 is the buy signal in AIG.

Whenever you're looking at any technical price pattern, it's critical to think in terms of buyers and sellers. Rectangles and other price pattern names are a good quick way to explain what's going on in this stock, but they're not the reason it's tradable. Instead, it all comes down to supply and demand for shares.

That resistance line at $52, for example, is a price where there's an excess of supply of shares; in other words, it's a place where sellers have been more eager to take recent gains and sell their shares than buyers have been to buy. That's what makes the move above it so significant -- a breakout indicates that buyers are finally strong enough to absorb all of the excess supply above that price level. When $52 gets taken out, AIG becomes a high-probability buy.

Apple

It's been a while since we looked at Apple (AAPL). Sshares of the tech giant have been moving lower for the last couple of months, down more than 4% since the calendar flipped over to January. Even though Apple's recent price action hasn't looked particularly auspicious, on closer inspection this chart looks ready to flash a buy signal.

>>5 Rocket Stocks Ready for Blastoff This Week

Apple is currently forming an inverse head and shoulders pattern, a bullish setup that indicates exhaustion among sellers. The pattern is formed by two swing lows that bottom out around the same level (the shoulders), separated by a deeper low (the head). A breakout above the neckline is the buy signal; AAPL's neckline is right at $540. That means we could see a breakout signal in the next few sessions.

The fact that Apple's neckline is sloping lower means that the upside target is lower than a more textbook trade would offer. Resistance at $570 (the dashed line on the chart) looks like the next price objective when and if the breakout happens. Investors looking for an early-warning sign should keep an eye on momentum, measured by 14-day RSI. Our momentum gauge is testing a long-term downtrend. If RSI breaks out, expect price to follow suit.

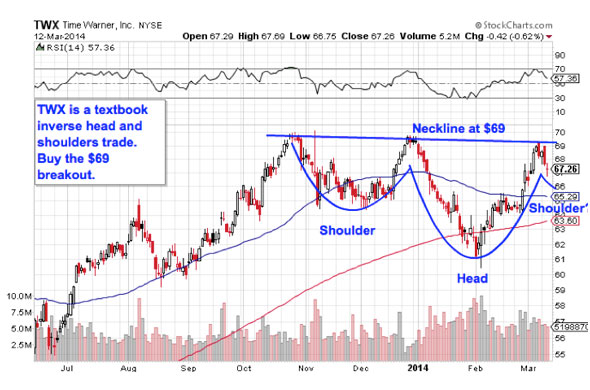

Time Warner

There's a similar setup in play this week with shares of entertainment stock Time Warner (TWX). Time Warner is forming an inverse head and shoulders with a flatter neckline at $69. Right now shares are forming their right shoulder, but even if that textbook pattern doesn't get completed, the trading implications are just the same: a breakout above that $69 level is the signal that shares are buyable.

A push through the neckline in TWX puts this stock's upside target at $77, an 11.5% move. When that buy signal comes, I'd recommend keeping a protective stop at the 50-day moving average. It's a decent approximation for this stock's shoulder level.

To see this week's trades in action, check out the Must-See Charts portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

RELATED LINKS:

>>5 Utility Trades That Could Charge Your 2014 Gains

>>3 Stocks Under $10 Making Big Moves

>>4 Big Stocks Getting Big Attention

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author was long AAPL.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to

TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.Follow Jonas on Twitter @JonasElmerraji

No comments:

Post a Comment